BullionStar

BullionStar- Posts : 7

Join date : 2024-02-16

New Report: Why a Powerful Silver Bull Market May Be Ahead

New Report: Why a Powerful Silver Bull Market May Be Ahead

Tue Apr 23, 2024 6:53 pm

Hello, everyone! We've just published a detailed report that explains why a powerful bull market may be ahead and how it is likely to evolve into a silver squeeze:

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Here are some highlights from the report:

1) Silver is quite cheap by historical standards. See the inflation-adjusted price of silver, for example:

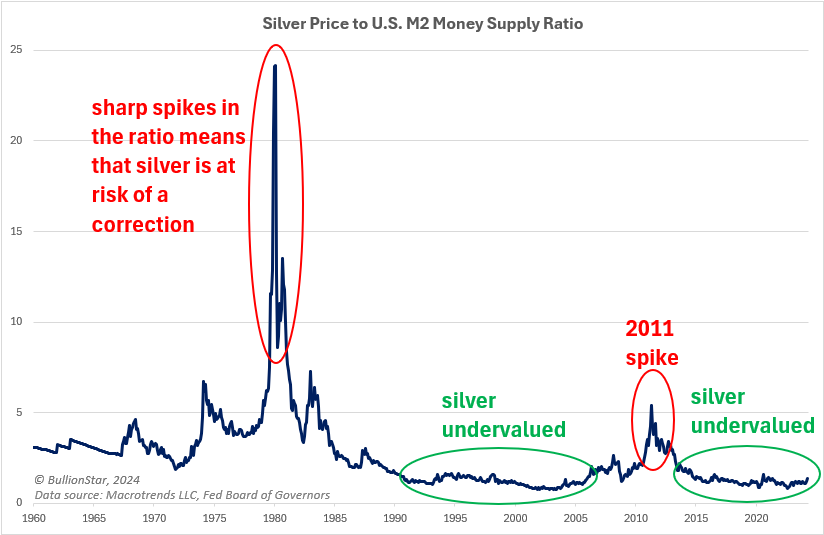

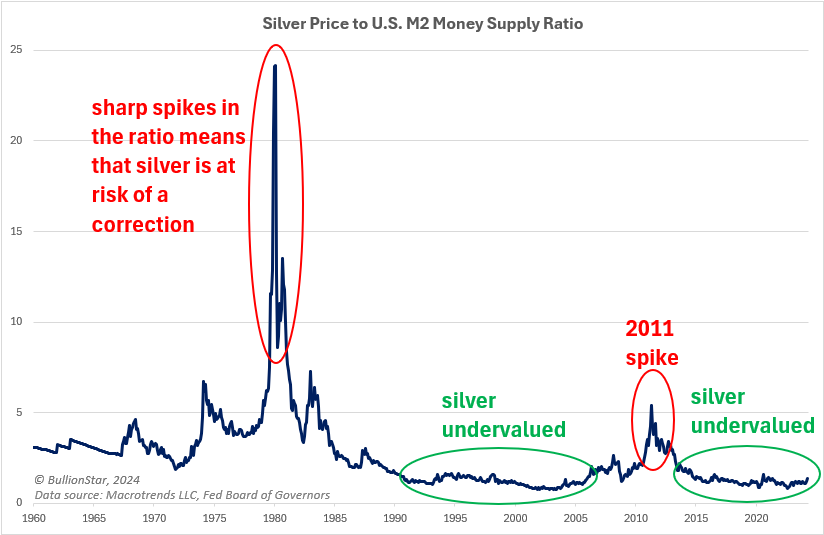

2) The ratio of silver’s price to the United States M2 money supply also shows that silver is quite undervalued by historical standards:

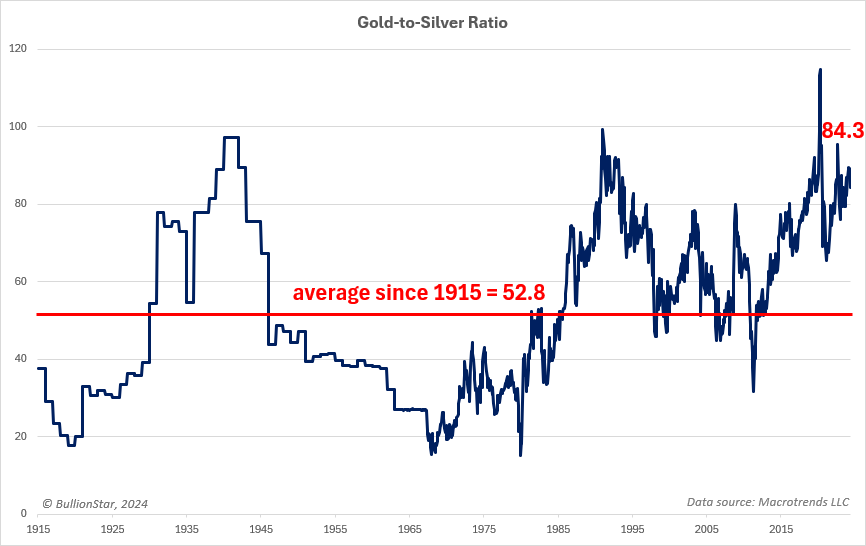

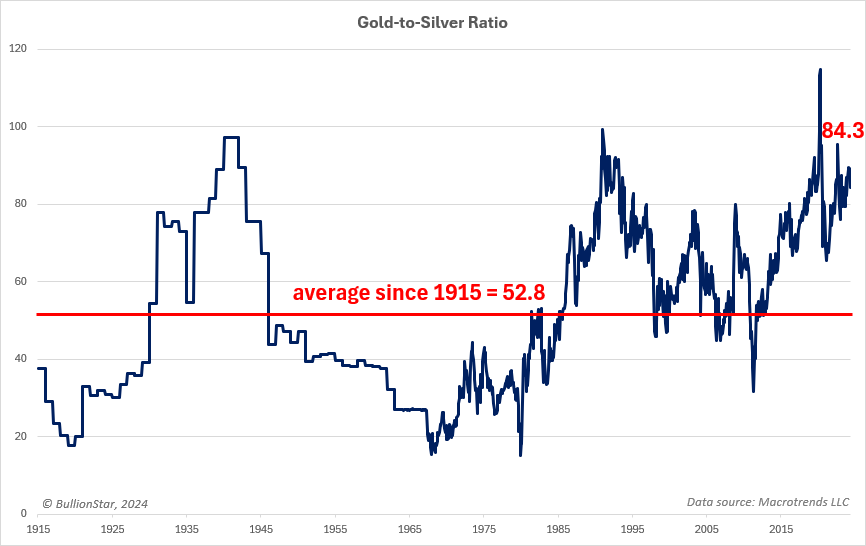

3) The current gold-to-silver ratio is a lofty 84.3, which means that silver is extremely undervalued relative to gold based on historical standards:

4) Strong demand for silver and lackluster supply growth has created a structural deficit in the silver market for the past few years:

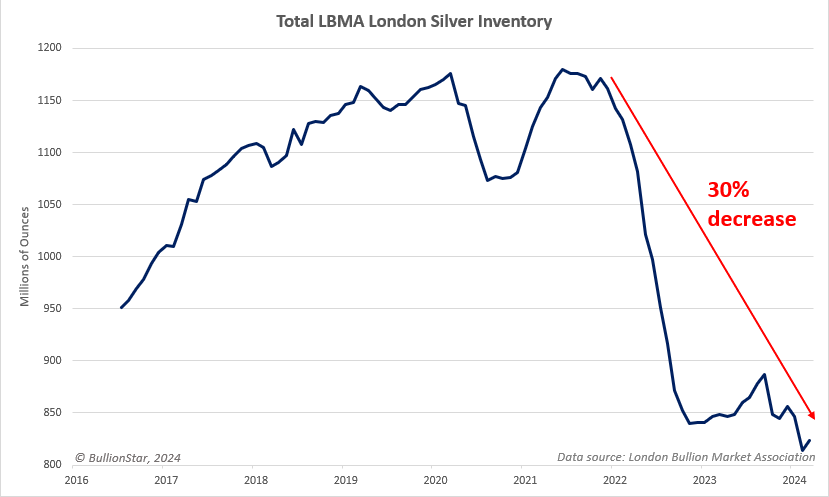

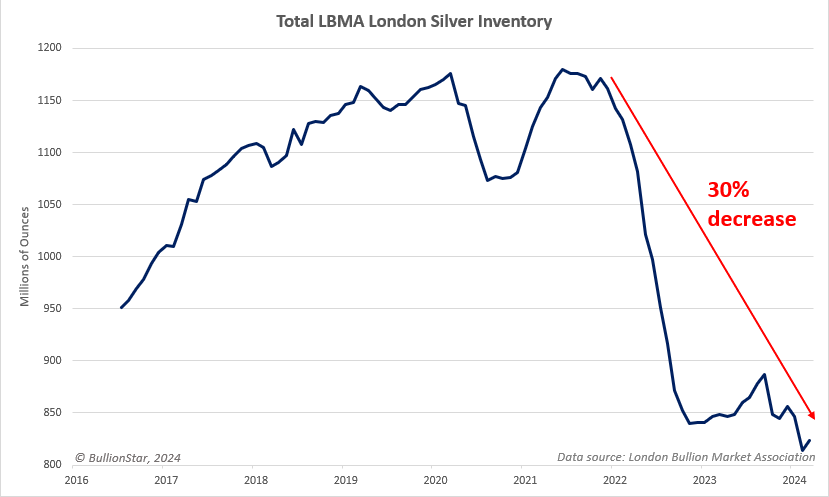

5) The past few years' silver deficit is causing the above-ground supply of silver to dwindle at a rapid rate:

6) Silver has recently broken out from a long-term triangle pattern, which means that a powerful bull market is likely ahead that could take silver to its prior 2011 highs of approximately $50 and even higher after that:

We hope you read the whole report, which has many more charts and additional points:

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Please let us know what you think in the comments!

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Here are some highlights from the report:

1) Silver is quite cheap by historical standards. See the inflation-adjusted price of silver, for example:

2) The ratio of silver’s price to the United States M2 money supply also shows that silver is quite undervalued by historical standards:

3) The current gold-to-silver ratio is a lofty 84.3, which means that silver is extremely undervalued relative to gold based on historical standards:

4) Strong demand for silver and lackluster supply growth has created a structural deficit in the silver market for the past few years:

5) The past few years' silver deficit is causing the above-ground supply of silver to dwindle at a rapid rate:

6) Silver has recently broken out from a long-term triangle pattern, which means that a powerful bull market is likely ahead that could take silver to its prior 2011 highs of approximately $50 and even higher after that:

We hope you read the whole report, which has many more charts and additional points:

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Please let us know what you think in the comments!

denby

denby- Posts : 319

Join date : 2021-07-25

Age : 73

Location : Scotland

Re: New Report: Why a Powerful Silver Bull Market May Be Ahead

Re: New Report: Why a Powerful Silver Bull Market May Be Ahead

Wed Apr 24, 2024 8:01 am

Great silver report.

China USD silver prices about $3 higher per oz than the current Western prices per oz.

Silver will keep travelling from West to East.

India and other Eastern countries are on a buying spree.

West will lose the power to manipulate these prices very soon.

About time too, a bit of real price discovery would be a nice change. To see a free market in PM's would be quite exciting for us to witness.

China USD silver prices about $3 higher per oz than the current Western prices per oz.

Silver will keep travelling from West to East.

India and other Eastern countries are on a buying spree.

West will lose the power to manipulate these prices very soon.

About time too, a bit of real price discovery would be a nice change. To see a free market in PM's would be quite exciting for us to witness.

Admin likes this post

Permissions in this forum:

You cannot reply to topics in this forum